|

About Us We are a pure play residential mortgage REIT with a focus on investing in a diversified risk-adjusted portfolio of residential mortgage-related assets in the U.S. mortgage market. We are externally managed by AG REIT Management, LLC, an affiliate of Angelo, Gordon & Co., L.P. (TPG Angelo Gordon), a diversified credit and real estate platform within TPG. We primarily focus on acquiring and securitizing newly-originated residential mortgage loans within the Non-Agency segment of the housing market. We finance our acquired loans through various financing lines on a short-term basis and utilize TPG Angelo Gordon’s proprietary, best-in-class securitization platform to secure long-term, non-recourse, non-mark-to-market financing. As a programmatic aggregator and issuer of Non-Agency residential loan securitizations, MITT is committed to generating attractive risk-adjusted returns for our stockholders over the long-term through dividends and capital appreciation. With MITT, investors have access to:

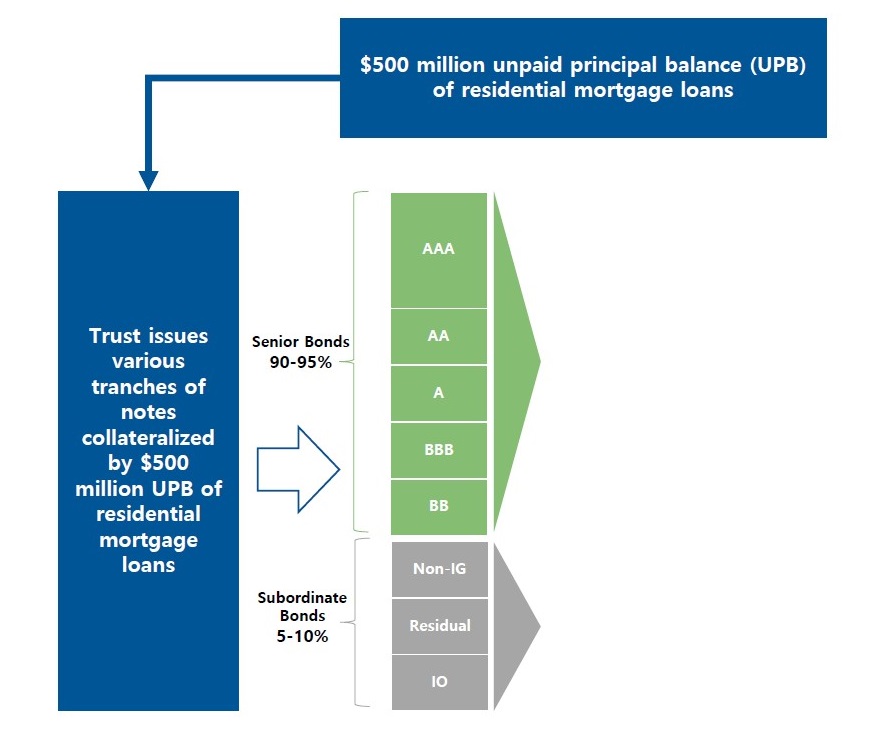

Our Securitization Business We use leverage to finance the acquisition of our residential mortgage loans in order to increase potential returns for our stockholders. When acquiring residential mortgage loans, we initially finance the acquisition using warehouse facilities or repurchase agreements on a short-term basis. Upon accumulating a targeted amount of residential mortgage loans, we then seek to transition our financing to long-term, non-recourse, non-mark-to-market financing though securitizations as market conditions permit. Upon securitization, we contribute residential mortgage loans into a securitization trust which issues various classes of bonds backed by the cashflows from the underlying mortgage loans. We typically sell the senior classes of bonds to unrelated third parties and, as the sponsor of the securitization, we are generally required to retain at least 5% of the fair value of the bonds issued. In order to comply with the risk retention rules in each securitization transaction, we generally purchase the most subordinated classes of bonds and the excess cash flow bonds, which include the bonds exposed to the first loss of the securitizations. We also purchase the bonds entitled to excess servicing fees and may purchase other bonds issued by the securitization trust. As the sponsor and depositor of these securitizations, we may retain a call option which enables us to acquire the loans from the securitization trust. This option can typically be exercised following the earlier of (1) an applicable anniversary date of the respective securitization (typically two or three years) or (2) the date at which the unpaid principal balance of the securitized loans has declined below a certain percentage (typically 10% to 30%) of the principal balance originally contributed to the securitization. Depending on market conditions, we could exercise the call option and re-securitize the loans or sell the loans to a third party. Below is an illustrative example of our securitizations: MITT deposits the loans into a Trust  MITT acquires $500 million newly originated Non-Agency residential mortgage loans from Arc Home or other third-party origination partners MITT Sells Senior Bonds to Third Parties

MITT Retains Subordinate Bonds

*A significant portion of the subordinate bonds we acquire through securitization is subject to the U.S. credit risk retention rules which materially limit our ability to sell or hedge investments as needed by requiring us to hold investments that we may otherwise desire to sell during times of severe market disruption in the mortgage, housing, or related sectors. Angelo, Gordon & Co., L.P. We are externally managed by an affiliate of TPG Angelo Gordon and we do not have employees. All of our officers and personnel who provide services to us are employees of TPG Angelo Gordon. Through our relationship with our manager, we benefit from TPG Angelo Gordon's deep investment expertise, long-standing relationships and substantial resources, which enables us to execute our strategy and achieve our investment objectives. Visit TPG Angelo Gordon’s website to learn more.

|